Error Message M8889 Account has been set as not relevant for Tax

Solve SAP error M8889 account not relevant for tax

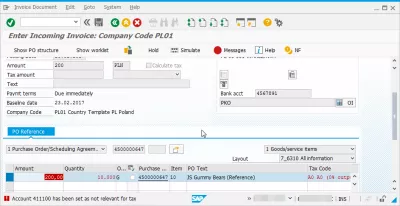

During the creation of an incoming SAP supplier invoice as part of the plan buy pay process in the operational procurement scenario, you might run into the error account has been set as not relevant for tax.

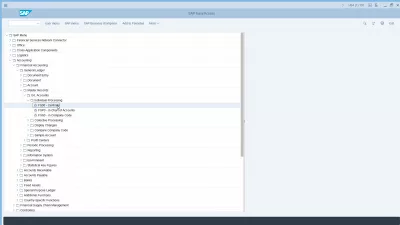

This SAP error simply mean that the account must be setup for the right kind of tax, which is feasible in transaction FS00 - display General Ledger account centrally, located in the SAP tree under accounting > Financial Accounting > general ledger > master records > G/L accounts > individual processing.

Once the error is solved, you will be able to proceed with the procurement lifecycle management by continuing to create a supplier invoice using this account.

Account has been set as not relevant for Taz Message No.M8889Operational Procurement online training

Account has not been set as relevant for tax

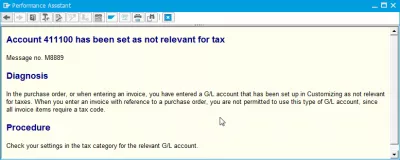

When going through the error account has not been set as relevant for tax, the issue is that the customizing must be updated to open the account for the right kind of tax, that is actually used in the SAP supplier invoice creation process.

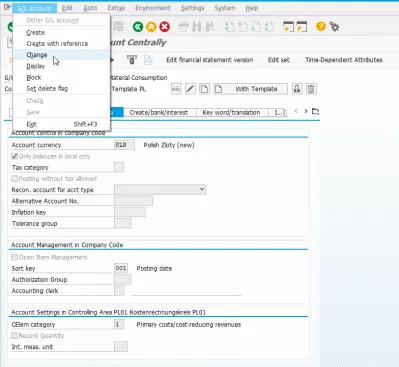

Open the correct GL account in the transaction FS00, display General Ledger account centrally.

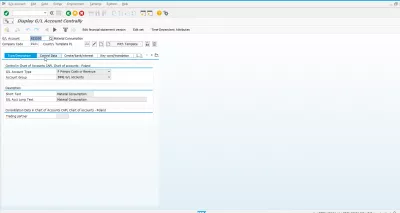

From there, open the second tab, called control data, in which the tax setting will be displayed for the GL account.

Account 415100 has been set as not relevant for taxChange GL account tax setting

Once in the control tab of the GL account, if you are in visualization mode, go to change mode by using the window's menu and click on change.

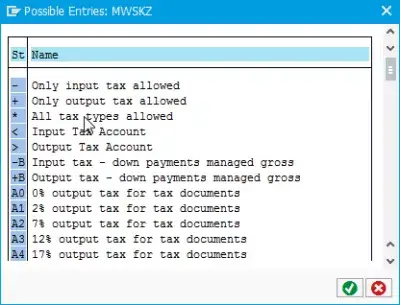

Then, click on the tax category field, and use the F4 key to open the entry help menu, that will display all kind of available taxes, such as:

- - only input tax allowed

- + only output tax allowed

- * all tax types allowed

- < input tax account

- > output tax account

- input/output tax down payments managed gross

- output tax for tax documents

More options or different ones might be offered to you, depending on your SAP system configuration.

Select the right type of tax for your case.

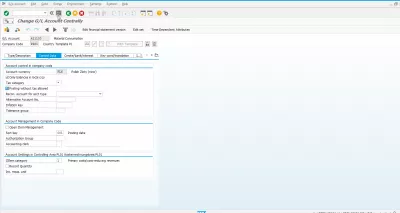

What is tax category on general ledger account?Save new tax category MWSKZ value

Once the right value has been selected for the tax category field MWSKZ, select the save icon to apply the change in the system.

Display messages might appear, telling you that the change has been successfully registered in the system, and that the sales tax code has been updated for example, which will appear as a warning.

You can proceed with your SAP supplier invoice creation and your operational procurement operations.

Frequently Asked Questions

- What does SAP error M8889 mean, account is not related to tax?

- This SAP error simply means that the account must be set up for the correct tax type. That is, account is not tax-relevant, tax code will be ignored.

- What does the M8889 error message in SAP indicate and how can it be addressed?

- This error indicates issues with tax relevance settings for an account. It can be addressed by adjusting the tax settings in the financial accounting module.

Yoann Bierling is a Web Publishing & Digital Consulting professional, making a global impact through expertise and innovation in technologies. Passionate about empowering individuals and organizations to thrive in the digital age, he is driven to deliver exceptional results and drive growth through educational content creation.